rank real estate asset classes by risk

1 Dec 2020. What kind of building are you investing in.

Ubs These 12 Massive Housing Markets Are Too Hot Global Real Estate Marketing World Cities

Since being founded in 1995 Harbor Group Consulting has remained steadfast in both its exclusive focus on.

. Real estate is a well-known asset class that has been used to build wealth for centuries defend against inflation and is sometimes referred to as recession-resistant. Real estate infrastructure. Im mainly looking at.

Welcome to Module 3. Bringing depth and credibility to insurance analysis. During a recession commercial real estate.

Although Class D properties arent best for investors Class A B and C properties are all solid options depending on your. -Multifamily -Retail -Office -Student living -Light. City Realty Asset Management Inc.

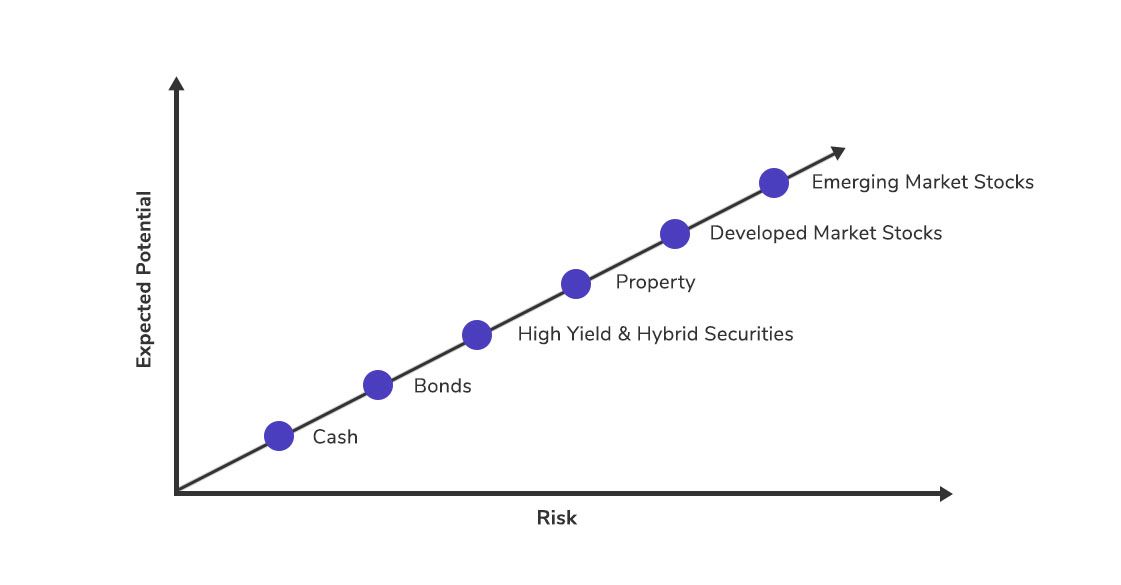

They are broad categories that include assets with similar characteristics and risk levels. The most common asset classes are cash and cash equivalents equity fixed-income. However today commercial real estate CRE is usually.

Estate Assets I Llc in Piscataway NJ. The trust employs a trust company to serve as the fiduciary. Real estate in terms of asset classes was often categorized within the sphere of alternative assets.

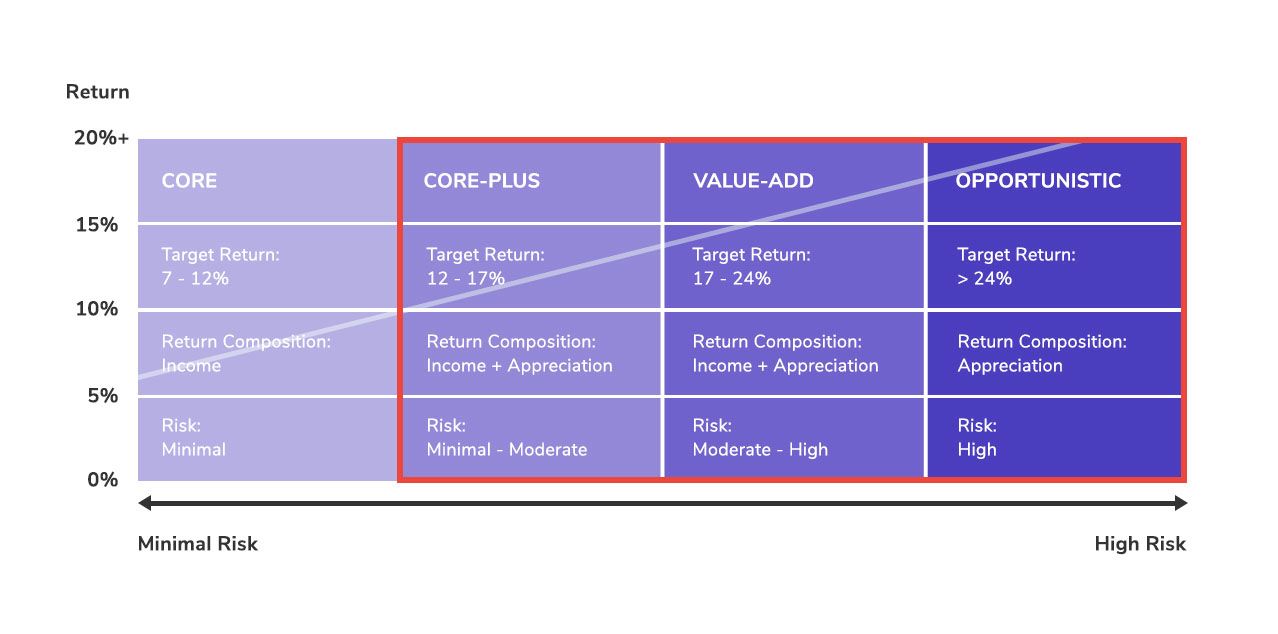

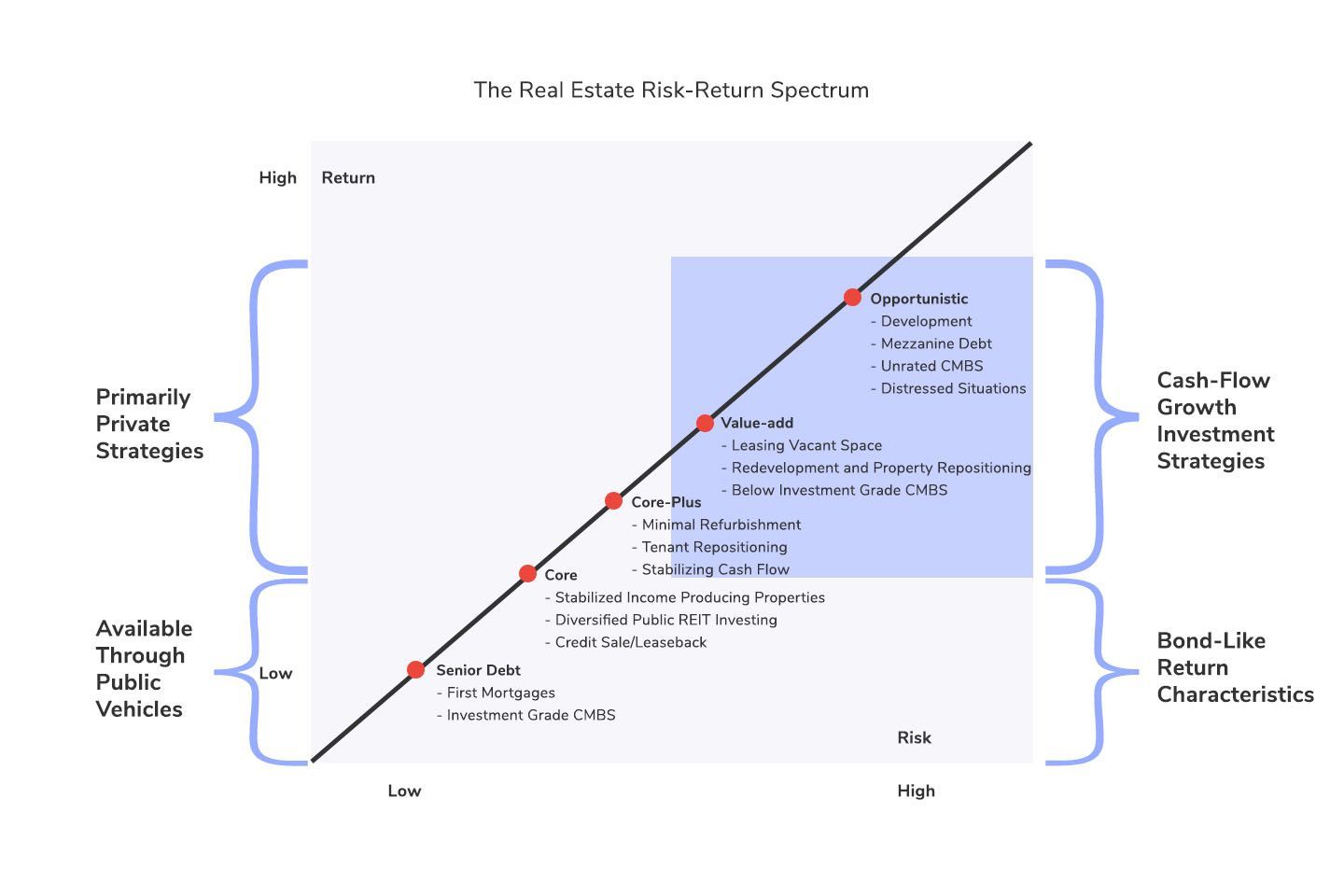

Chart The Historical Returns By Asset Class Over The Last Decade Know Your Real Estate Risk Reward. This module contains the final type of. Each real estate asset class has its pros and cons.

Three traditional asset classes are equities or stocks cash equivalents or a Money Market and fixed income or bonds. In commercial real estate this gets defined as Class A B C or D. Real estate has the highest risk and the highest.

In commercial real estate this gets defined as Class A. Additionally two common alternative asset. Name A - Z Sponsored Links.

Our deep understanding of commercial real estate assets of all types enables us to transact with borrowers in a way traditional banks and lenders cannot. The first asset class is real estate. Dear all Im having trouble to find arguments when ranking real estate asset classes in terms of risk.

Here are the types of asset classes ranging from high risk with high return to low risk with low return. Rank real estate asset classes by risk Wednesday June 15 2022 Edit. Real estate is a well-known asset that generates wealth for generations protects against inflation and is recession-resistant.

The Domestic Asset Protection Trust may hold investment assets and real estate including a personal residence. You are almost halfway through your journey to becoming an Alts Guru.

What Is My Investment Risk Tolerance Peerfinance101 Investing Finance Investing Money Management Advice

Internet Browser Market Share 1996 2019

How To Achieve Optimal Asset Allocation Investing Personal Financial Planning Investment In India

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Help Wanted Venture Capital Growth Company Help Wanted

The Real Estate Risk Reward Spectrum Investment Strategies

Important Two Things You Must Consider Before Deciding On A Category Age Risk Appetite In General You Should Be More Risk Averse As You Have Time

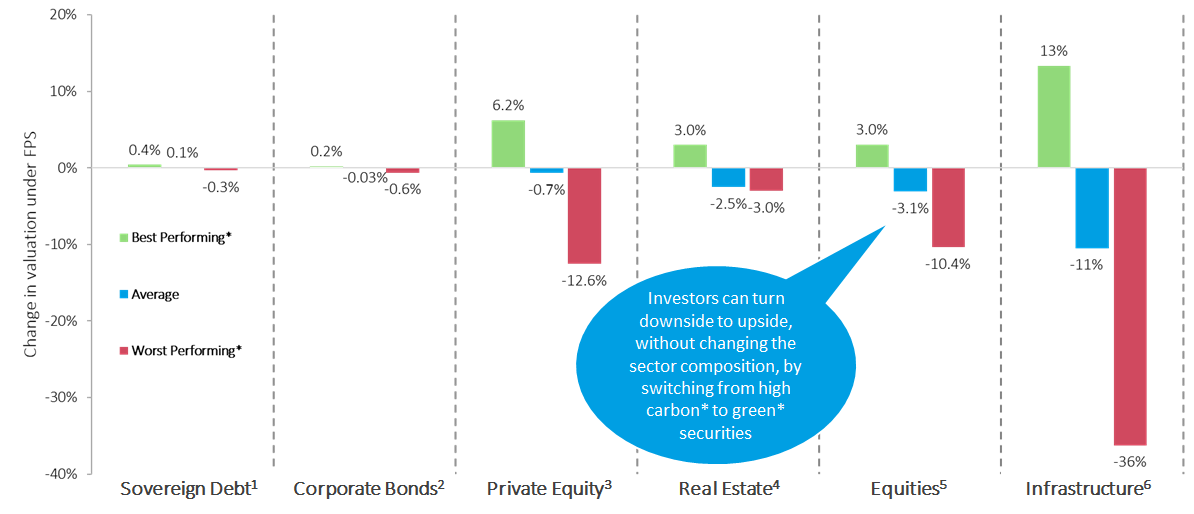

Implications For Strategic Asset Allocation Thought Leadership Pri

Asset Allocation Planning Your Asset Allocation Between Large Cap Mid Cap Small Cap And Other Asset Clas Small Caps Stock Market Investing Small Cap Stocks

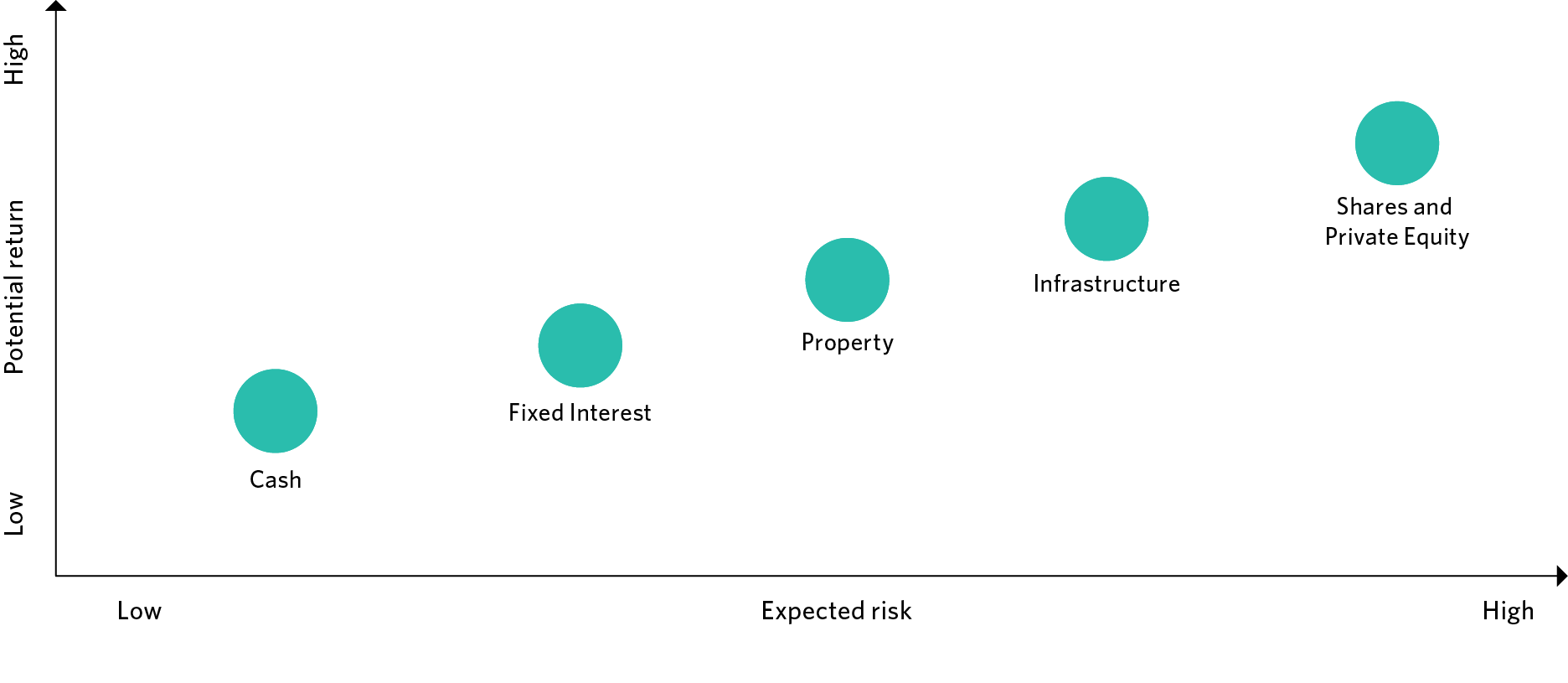

Asset Classes Explained Understanding Investments Unisuper

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Alternative Assets And Risk Management Insights Into Practices Observed From Fsra S Review Of Six Large Public Sector Pension Plans In Ontario Financial Services Regulatory Authority Of Ontario

2021 Global Real Assets Outlook Institutional Blackrock

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

Determining Risk And The Risk Pyramid

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)